We are reader-supported. When you buy through links on our site, we may earn an affiliate commission.

There are so many ways to have a fulfilling career. If you love the freedom of working on your own within the construction or real estate world, you likely qualify as an independent contractor. Check out everything you need to know about the independent contractor tax rate to understand what you’ll owe each year and how to stay ahead of the financial curve. You’ll keep your head above water without breaking a sweat.

What Is an Independent Contractor Tax Rate?

An independent contractor tax rate is the federal tax rate you pay as a sole proprietor or a member of a professional partnership. You become legally required to pay it if you make more than $400 per year with your independent work. The same research shows that 92.35% of your income is liable for this tax if you earn that income through self-employment, so it’s crucial to stay on track with your payments.

Who Counts as an Independent Contractor?

The Internal Revenue Service (IRS) helps people determine if they’re an independent contractor based on multiple factors. First, consider if you work for someone who hired you. If you generate your income on your own, you’re self-employed and count as a contractor. You can also count if you’re in business for yourself, even if you’re part of a professional partnership.

You can also figure this out by reflecting on when your current job began. Did you complete an interview process and fill out a W2 form? W2 forms indicate that an employer is sending your paycheck to your bank account, complete with all of your taxes paid from the total amount. If you work without having filed a W2, you’re an independent contractor.

Taxes You’ll Need to Pay While Working Without an Employer

It’s always good to start your journey into the world of taxes by visiting a local certified public accountant (CPA). They’ll know the specific tax rates applicable to your county and state. They’ll also be able to review any income statements you want to bring to better calculate your total income and how much you owe.

If you just want to break down the independent contractor tax rate, it’s time to grab a notepad. First, you’ll need to pay federal income tax on your annual income. It varies between 10%-37% based on which tax bracket your income falls within.

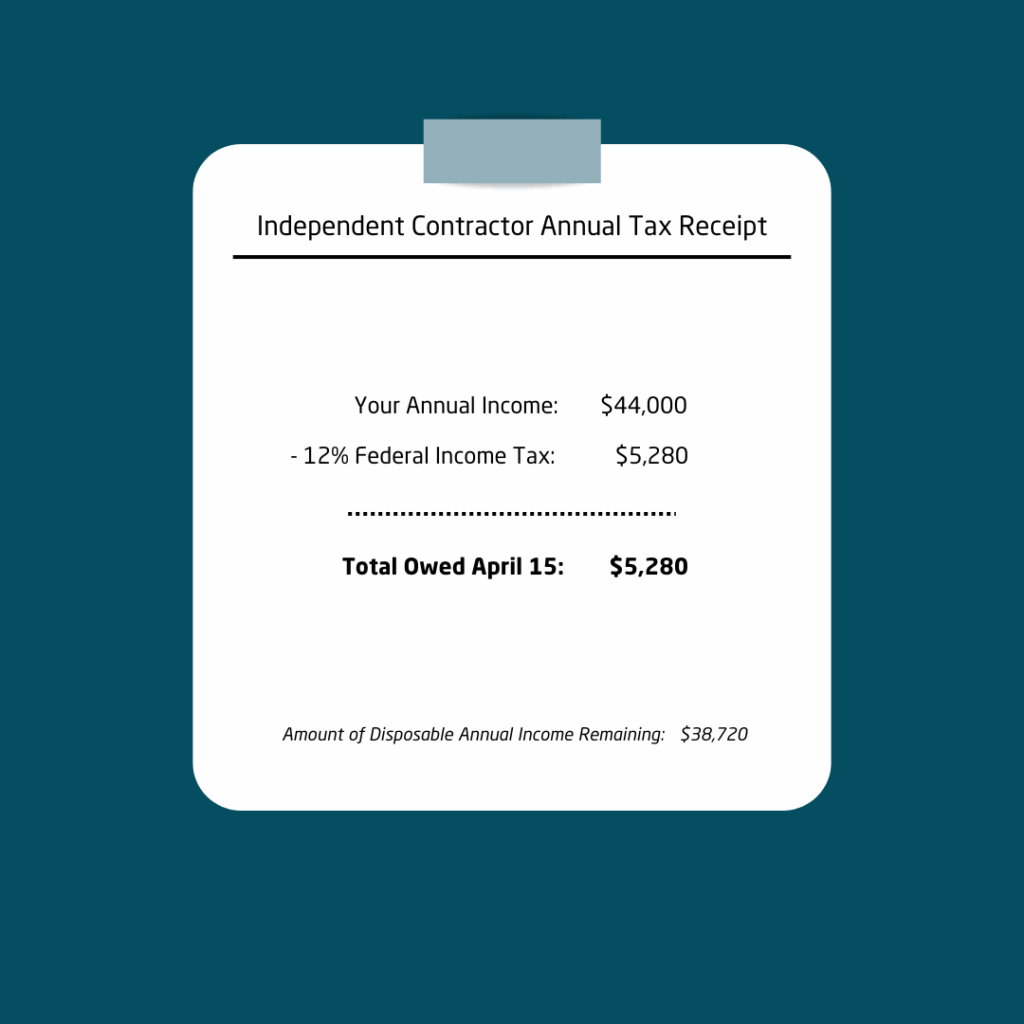

Imagine that you’re making $44,000 each year. You’d fall within the 12% tax bracket. You’d owe $5,280 in income tax to the federal government by the time of your annual filing in April. If you’re like the 28% of homeowners planning on renovating their kitchen, you might want to start saving money for your taxes before your project begins. Tax bills for independent contractors include much more than the federal income tax.

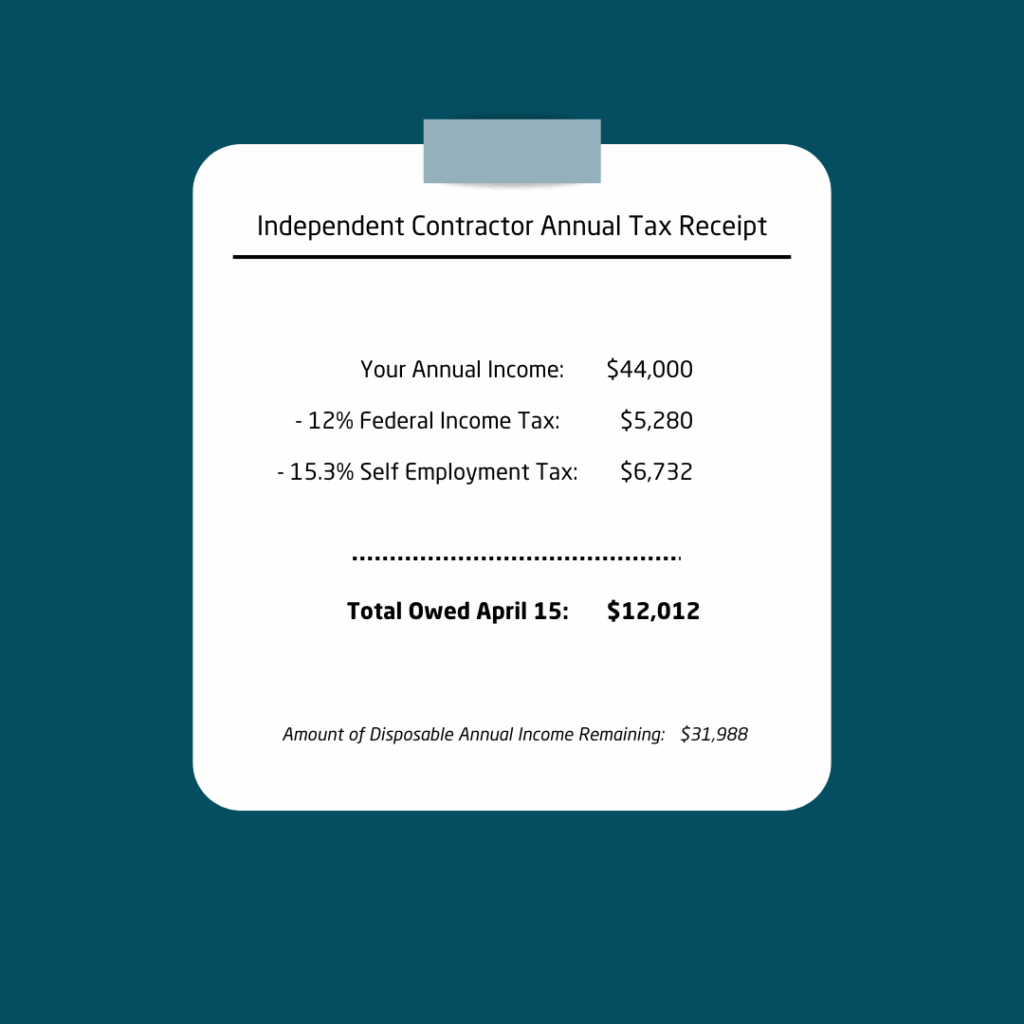

Next, you’ll need to pay your self-employment tax. It’s currently at 15.3% of your total annual income, which breaks down into 12.4% paid into Social Security and 2.9% into Medicare. Normally, an employer would pay half of those percentages. Since you’re an independent contractor, you have to pay both halves — it totals 15.3%. If your annual income is $44,000, you would need to pay $6,732 to the federal government in addition to the $5,280 in income tax.

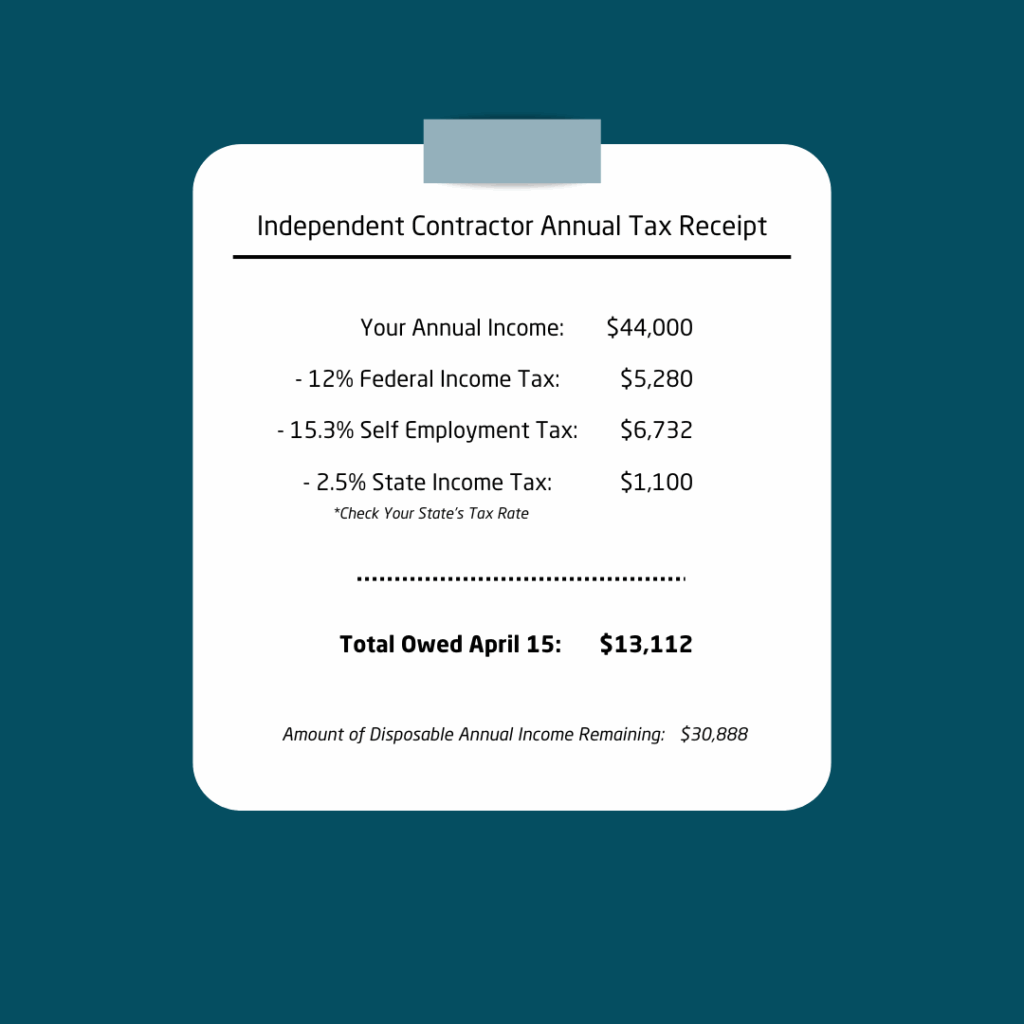

State and municipal taxes also have to factor into each paycheck. Check your state’s Department of Revenue website to find your specific rate. If you’re making $44,000 annually in Arizona, you’d owe 2.5% to the state government to help pay for public services provided by the state. That would add up to $1,100 in addition to your $6,732 in self-employment tax and $5,280 in income tax.

Municipal taxes vary by county. They may include sales and use taxes, depending on your business. Sales taxes apply to physical products. Use taxes relate to buying, selling or leasing property within your state. A CPA licensed in your state tax laws can help you identify which of these you qualify for, based on your job.

Tax Deadlines to Add to Your Calendar

If you add up the taxes calculated for the average independent contractor making $44,000 mentioned above, that means that person has to pay $13,112 out of that $44,000 by April of each year. That’s more than most people could pull out of savings at the drop of a hat.

Managing independent contractor tax rates is much easier if you add quarterly deadlines to your calendar. They can shift each year, but you can check the IRS website for any updates to these standard deadlines:

- Quarter 1 (Income made during January 1 to March 31): April 15

- Quarter 2 (Income made during April 1 and May 31): June 15

- Quarter 3 (Income made during June 1 through August 31): September 15

- Quarter 4 (Income made during September 1 through December 31): January 15 of the following year

You’ll still need to file your taxes with a CPA every April to ensure you made the correct quarterly payments. However, breaking your total taxes into quarters makes it much easier to pay. The contractor making $44,000 annually would only need to pay $3,278 every few months rather than a bill for $13,112 in April.

It’s crucial to note that the second quarter of the tax year is only eight weeks long. You’ll likely need to double the amount of money you set aside for taxes during that period.

Tips for Organizing Your Taxes

Once you’re ready to set money aside for your federal and state tax bills, use a few tips to track your progress. Contractors often take these steps to simplify the process:

- Divide your quarterly income by your state and federal tax rates to determine how much to take out of each paycheck (or calculate how much you’ll need to save every month if your income fluctuates by project).

- Save your tax money in a separate savings account.

- Use a spreadsheet to note your sources of income, the taxes deducted from each one and any business expenses you might deduct in April.

- Meet with a CPA quarterly if your income isn’t the same each month to ensure you’re putting enough aside for tax payments.

- Bookmark the IRS tax payment page and the link you’ll need to pay your state’s income tax so you know which websites to use each quarter.

It’s normal if this feels overwhelming at first. As your first year as an independent contractor passes, you’ll get used to your new routine. Remember, you can always call a CPA licensed in your state for guidance if you have questions.

Stay on Top of Your Tax Payments

The independent contractor tax rate is a bit confusing for everyone. Once you know how much you make each year, how much to set aside for taxes and how often to pay them, you’ll be well on your way to potentially earning a refund in April.